Troy's briefs - changed weekly - rebates and contributions, EU style.

There is a lot of comment in the UK press today on our nations payments to the European Union (EU).

This week Premier Blair admitted that he has given up any hope of retaining all of the rebate on payments from the UK to the EU.

There is a lot of comment in the UK press today on our nations payments to the European Union (EU).

This week Premier Blair admitted that he has given up any hope of retaining all of the rebate on payments from the UK to the EU.

.

The current fuss is all centred on the 25 member states of the EU agreeing their huge spending budget. The Commissioners have asked for 1.24 per cent of the EU's Gross Domestic Product (GDP), a nice round One Trillion euros !

So what is this rebate all about? Well in a few words it is a rebate on UK tax payers' contribution to the EU, negotiated in 1981 (the formula is so complicated only the very best of PhD's can understand it). The rebate (currently £ 3.2 billion) compensates the UK because under the payments formula to the EU (even more complicated) the UK receives less farm subsidies than is 'reasonable' under the formula as a ratio to our net payments. Why not just reduce the UK's payments? Oh no, the system is far too complex and politically loaded. Daft ? Oh yes, very !

So what is this rebate all about? Well in a few words it is a rebate on UK tax payers' contribution to the EU, negotiated in 1981 (the formula is so complicated only the very best of PhD's can understand it). The rebate (currently £ 3.2 billion) compensates the UK because under the payments formula to the EU (even more complicated) the UK receives less farm subsidies than is 'reasonable' under the formula as a ratio to our net payments. Why not just reduce the UK's payments? Oh no, the system is far too complex and politically loaded. Daft ? Oh yes, very !

.

Tony Blair's crusade against the EU's farm subsidy system, better known as the Common Agricultural Policy, which our beloved leader began after the acrimonious collapse of the EU budget summit has been a total failure. Blair's attempts at trying to improve the crazy system are best summed up by Daniel Gros, the Director of the Centre for European Policy Studies in Brussels who said: '' He did not measure up to his own ambitions. His ambitions were very large but the result was zero.''

.

Indeed; anyway the rebate from the EU is clawed back from the UK's annual payments retrospectively and is included in the figures published by the HM Treasury each year - two years subsequently.

.

To further complicate the issue the rebate is calculated by the EU, on a calendar year basis, where as the HM Treasury reports accounts on a UK fiscal year (April to April) basis.

.

The last published (UK fiscal 2003-4) sums as I understand them are - payments to the EU £12.3 billion, receipts back from the EU £7.8 billion

.

£3.2 billion, has beeen clawed back from the 2004-5 payment under the current rebate formula.

.

.

The last published (UK fiscal 2003-4) sums as I understand them are - payments to the EU £12.3 billion, receipts back from the EU £7.8 billion

.

£3.2 billion, has beeen clawed back from the 2004-5 payment under the current rebate formula.

.

The EU payment rebate in a few years time would be worth some £7 billion under the present formula. Blair's re-negotiation of the Thatcher agreed rebate formula will (in round figures) cost the UK an extra £1 billion of tax payers money each year. In payment terms our net 'subscription' to the EU is (in my opinion) currently £4.5 billion and rising to at least £ 5.5 billion next year.

.

.

Labour MPs are being briefed to comment, in order to justify Blair's failure to save the rebate, that in a few years time under the current 'unfair' EU payments system the UK would go from the second highest contributor to the second lowest. The only possible way this 'statistic' could be arrived at is by referring to payments as a ratio of Government spending. (The 10 new EU members all have comparatively low government spending compared to the UK, France, Spain and Germany.)

.

Importantly, the cost of the UK's compliance to the EU in terms of paying for structures and regulation was this year independently estimated (click here for more detail http://verybritishsubjects.blogspot.com/2005/07/cost-of-regulation-150-billion.html ) at 10 per cent of the UK's GDP - thus currently costing the UK some £98 billion per year. In summary: the price of being a member of the EU is currently some £4.5 billion per year - the cost however is an extra £98 billion !

.

In the meantime the various funds are given and / or lent ( very conditionally - on a double match funding bases, £1 back from the EU to every £2 from UK taxpayers) to UK businesses and 'social projects' under the guise of 'European Money' - via Regional Development Agencies and Business Links. So continues the bribery of British entrepreneurs (the nation's small business community), fooling them into thinking the EU is doing them a favour. Such is the extent of the great deception.

.

Importantly, the cost of the UK's compliance to the EU in terms of paying for structures and regulation was this year independently estimated (

.

In the meantime the various funds are given and / or lent ( very conditionally - on a double match funding bases, £1 back from the EU to every £2 from UK taxpayers) to UK businesses and 'social projects' under the guise of 'European Money' - via Regional Development Agencies and Business Links. So continues the bribery of British entrepreneurs (the nation's small business community), fooling them into thinking the EU is doing them a favour. Such is the extent of the great deception.

.

.The ins and outs of public money - estimate for year 2005/6.

.

.

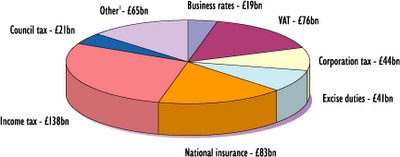

.Above, the ins - how British taxes are raised - total about £487 billion and rising.

Above, the outs - where British taxpayers' money is spent.

Total public spending is expected to be around £519 billiion this year, around £8700 for every man, woman and child in the UK. It is set to rise to around £549 billion in 2006-07 and to £580 billion in 2007-08. Which means of course that taxes will have to rise!

(Source: HM Treasury)

PT

2 comments:

Tony Blair was quite right to point out that, without the UK rebate, Britain would be the largest net contributor to the EU budget, paying 15 times more than France. It was precisely this imbalance which prompted Margaret Thatcher to fight for the rebate. It was never properly explained, however, why this ridiculous anomaly arose in the first place.

One of many remarkable episodes which Richard North and I were able to bring to light in our book The Great Deception, just republished in a new updated edition, was the bizarre story behind the setting up of the Common Agricultural Policy in the 1960s. This was triggered off by the crisis facing France, through the runaway bill she was paying to subsidise French farmers for producing food nobody wanted.

President de Gaulle was terrified that this would bankrupt the French state, provoking social collapse. The French therefore cunningly devised a CAP to get other countries to buy their surplus food and foot their subsidy bill. The real reason why de Gaulle twice vetoed British entry was that it was vital first to get these arrangements agreed.

Otherwise Britain could have sabotaged a system deliberately designed to benefit France, from which Britain, because she imported more of her food than anyone else, would be the biggest loser. Not only would she have to pay levies to Brussels for the food she imported, but, with a smaller farming sector, she would also get fewer subsidies.

Only in 1969 did France get her way, at which point she needed Britain in, and Edward Heath accepted the absurd arrangement. Within a decade, with the CAP then taking up 90 per cent of the entire budget, Britain would become the biggest contributor.

Hence Mrs Thatcher's fight for her rebate. But even this was only a partial solution, because Britain's farmers have continued to receive dramatically smaller subsidies than their competitors, contributing to the crisis which in recent years has brought much of British agriculture to its knees.

Thus are we still living with the problems created by that French stitch-up of 40 years ago, for reasons now almost lost in the mists of time. For the full story, I naturally recommend The Great Deception: Can The European Union Survive?, just published by Continuum at £9.99.

I looked into the issue of how many of our laws are from the EU in some detail before the General Election.

The answer depends on the precise question. I always use the phrase “about 70% of our new legislation originates in Brussels.” You could also says “comes from Brussels.”

That’s safe because it covers English law which is made to fit in with EU “law” or copy it, whether or not that is mandatory.

I analysed major Acts of Parliament for two years to see which (a) were specifically to enact a Directive in English law (b) included in them such enactments (c) included other mandatory requirements from the EU (d) included measures to fit in with other previously enacted EU “laws” and (e) included measures to fit in – but were not mandatory – with EU law

Frankly, the answer was nearly 100%. “e” catches most of what is left after the rest.

If you ask a narrower question – what proportion of new English laws are EU laws simply mandatorily enacted here, then you get a lower figure, perhaps 30%. I say “perhaps” because the question is open as it does not refer to a fixed time period. Some years it will be higher than 30%, some lower.

I have not looked at statutory instruments, but, as far as the answer being defined by the question is concerned, the answer would be similar.

Are SIs laws? Yes in one sense, but no in the sense that they are simply the extension of an item already covered in primary legislation. In other words you could be double-counting.

What all of this means is that you could technically argue forever and not really get anywhere. Therefore the search for definitive proof of 70% or any other figure is illusory.

The truth is that Britain has largely lost its independent law-making authority and thus one of the key elements of its democracy. And a high proportion of our new laws are really made in the EU.

For illustrative purposes 70% is a good headline figure which is easily defended. It will be challenged from time to time, but so would any figure. I think 70% is safe to use and should be heavily promoted! After all we are in politics not academia and so we are talking a different language……

Piers

Post a Comment